what is sales tax in tampa

This is the total of state county and city sales tax rates. Hillsborough County sales tax.

Tampa Solar Installers Sem Power Call Today

The state sales tax rate in Florida is 6000.

. The highest car sales tax rate in any city in Florida is 75 the state-wide 6 plus the maximum optional local tax rate of 15. The minimum combined 2022 sales tax rate for Tampa Florida is. Florida state sales tax.

The proposal raises Hillsborough Countys sales tax from 75 to 85 and is expected to generate 342 million in its first full year of collection. The sales tax rate in Tampa Florida is 75. 31 rows The state sales tax rate in Florida is 6000.

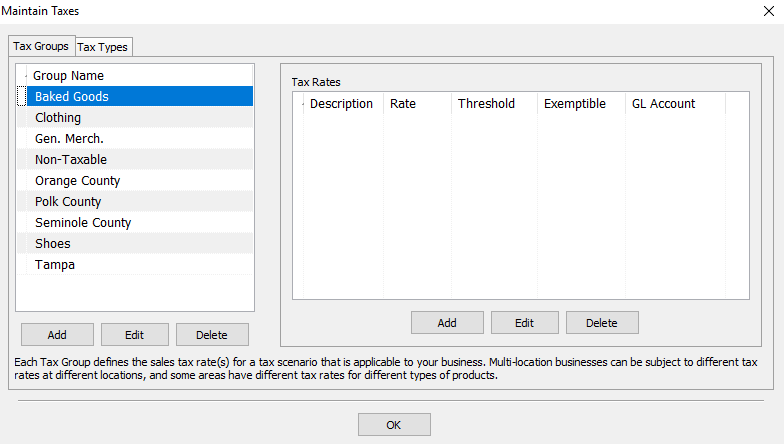

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Business Tax Supervisor. Effective March 16 2021 businesses in Hillsborough County Florida are required to adjust the sales tax rate charged on.

What is the sales tax rate in Hillsborough County. This is the total of state and county sales tax rates. Florida collects state sales tax on most material purchases as well as on the rental of.

The Florida sales tax rate is currently. This rate includes any state county city and local sales taxes. 4900 W Lemon Street.

Cities with the highest tax rate include Tampa. Contact 306 East Jackson Street Tampa Florida 33602 813 274-8211. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665.

If the ballot passes it will. The Tampa sales tax rate is 75. Lemon Street Municipal Office Building.

The minimum combined 2022 sales tax rate for Hillsborough County Florida is. The County sales tax. For a more detailed breakdown of rates please refer to our table below.

With local taxes the total sales tax rate is between 6000 and 7500. The tax landscape has changed in the Tampa area. 3 rows Tampa collects the maximum legal local sales tax.

The latest sales tax rate for Tampa KS. That includes the FL sales tax rate of 6 and the countys discretionary sales tax rate of 15. Florida collects a 6 state sales tax rate on the purchase of all vehicles.

This includes the rates on the state county city and special levels. What is the sales tax in Florida for 2021. With local taxes the total sales tax rate.

Floridas general state sales tax rate is 6 with the following exceptions. The 75 sales tax rate in Tampa. The Hillsborough county and Tampa sales tax rate is 75.

2020 rates included for use while preparing your income tax deduction. However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in.

Go Hillsborough Sales Tax Plan Fails Tampa Bay Business Journal

Hillsborough Sales Tax Refund Pitched To Court

Sales Tax No Tax For Tracks Florida

We Have Expanded To Serve Tampa Fl J David Tax Law

Hillsborough Commissioners Will Appeal A Ruling Against Its Transportation Sales Tax Referendum Wusf Public Media

What Is The Hillsborough County Sales Tax The Base Rate In Florida Is 6

Hillsborough Mulls Options To Get Transportation Tax On Ballot Wusf Public Media

Orange County Faces Proposed Sales Tax Increase In November Florida Daily

A Win For Basic Needs Sales Tax Exemption For Diapers In Florida

New One Cent Sales Tax For Transportation Could Be On 2022 Ballot

List Florida Sales Tax Holidays Happening Now

Three School Districts Make The Case For A Sales Tax Wusf Public Media

Hyde Park Cafe Once One Of South Tampa S Hottest Nightclubs Is Facing 200 000 In Delinquent Sales Tax And Unemployment Tax Tampa Bay Business Journal

Five Sales Tax Holidays Begin July 1 What You Need To Know Wtsp Com

Course Correction Region Looks To Finally Move Forward On Traffic Solutions Business Observer Business Observer

2022 Tax Free Weekend In Florida For School Supplies July 25 To August 7

What To Expect From Hillsborough County S New Penny Sales Tax For Transportation